What is Regulation F?

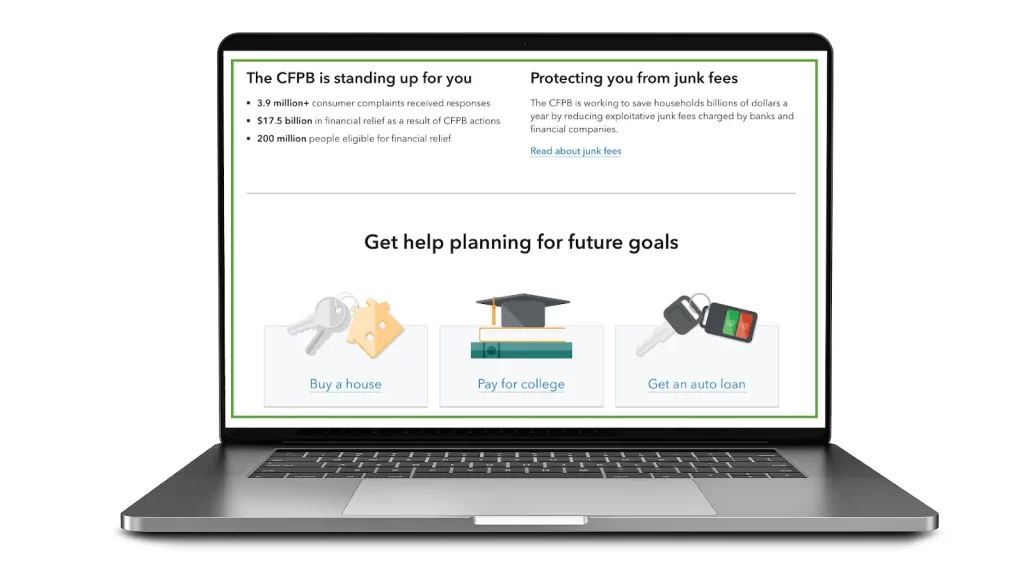

The Consumer Financial Protection Bureau (CFPB) drafted Regulation F, a set of rules that govern how debt collectors interact with consumers. The CFPB created these rules in 2013 to update and clarify the Fair Debt Collection Practices Act (FDCPA).

What does Regulation F provide?

Regulation F provides consumers with a number of protections against unfair, deceptive, or abusive debt collection practices. These protections include:

- The right to be informed about the debt collector, the debt, and the original creditor.

- The right to dispute the debt.

- The right to be treated fairly and respectfully by the debt collector.

- The right to be free from harassment, threats, and abuse from the debt collector.

- The right to stop the debt collector from contacting you.

How does Regulation F benefit consumers?

Regulation F benefits consumers by giving them more power to protect themselves from unfair debt collection practices. For example, it allows consumers to dispute debts that they believe are not valid, and it prohibits debt collectors from harassing or threatening consumers. This can help consumers to avoid having to pay debts that they do not owe, and it can also protect them from emotional distress.

What should collection agencies be doing?

Collection agencies should be complying with Regulation F in all of their interactions with consumers. This means that they should:

- Provide consumers with accurate information about the debt, the original creditor, and their rights under Regulation F.

- Only contact the consumers at certain times and places.

- Avoid using deceptive or abusive language or practices.

- Stop contacting consumers if they have disputed the debt.

What remedies do consumers have if a debt collector violates Regulation F?

Consumers who believe that a debt collector has violated Regulation F have a number of remedies available to them. They can:

- File a complaint with the CFPB.

- Sue the debt collector in federal or state court.

- Contact their state’s attorney general’s office.

- Contact a nonprofit consumer organization for help.

By understanding rights under Regulation F, consumers can protect themselves from unfair debt collection practices and get the help they need if they have been violated.